Summary

- Our European Equity team believes investors should look forward to the coming months with mild optimism given current market conditions.

- Supportive valuations, the potential for incremental improvements in the macroeconomic picture, helped in part by lower energy costs feeding through to lower manufacturing input prices, and the near-term prospect of a start to the rate-cutting cycle suggest European equities could extend their first-quarter strength.

- Our European Fixed Income team is currently highly positive on the outlook for the asset class. High yield levels translate into an attractive carry, while the likelihood for rate cuts as inflation falls to target levels further increases the performance potential.

European Equity

Readers of the financial media may assume that the only investment stories across the previous quarter were AI-related or focused on Nvidia’s share price gains. In the background, however, were Europe’s largest stocks. The STOXX Europe 50 Index charged 12.9% higher, in euro terms, over the opening quarter, outpacing the S&P 500 Index, which ended up 10.6% higher in dollar terms.

There was no common sector theme to the success of Europe’s mega-caps—to some extent reflecting how much more diverse the European stock market has become in recent years—but this mixed set of companies generally shared expectations-beating earnings performances: ASML, LVMH, and SAP all rose sharply on the day they reported results, while Novo Nordisk enjoyed another large earnings beat, driven by bumper sales of its type-one diabetes treatment, Ozempic, and its weight-loss drug, Wegovy. Incidentally, helping people get smaller has helped Novo Nordisk get bigger: It is now Europe’s largest company and the fifteenth-largest globally, with its share price having doubled over the last two years.

Outperformance by European mega-caps versus the broader US stock market has extended a trend that dates to late-2022 (Exhibit 1), a trend that may have passed many investors by, given that US mega-cap technology stocks have often seemed like the only game in town.

Exhibit 1: European Mega-Caps Have Outperformed the S&P 500 Index since Q4 2022

As at 29 March 2024

The performance quoted represents past performance. Past performance may not be indicative of future results.

Source: Dow Jones, FactSet

The market has been caught off guard by the strength of European mega-cap earnings, however, while a lower valuation base than their mega-cap US counterparts has undoubtedly also helped Europe’s biggest listed names outperform relatively.

Adding to the tailwinds, though, are possible rate cuts in the near future. The European Central Bank (ECB) could potentially enter this year’s much-anticipated rate-cutting cycle earlier than the Federal Reserve (Fed); indeed, the penultimate week of the quarter brought a surprise rate cut in Europe, albeit it was a 0.25% cut by the Swiss central bank rather than the ECB making its first monetary move.

We argued in our first quarter outlook that investors had probably gotten ahead of themselves in terms of their expectations about the scale of rate cuts and when they were likely to commence. That has proven true for the United States. Courtesy of an economy that has shrugged off the sharp rate hikes of 2022–2023, investors have been forced to tone down estimates for US rate cuts, both in terms of the anticipated number of cuts in 2024 and the Fed’s likely start date.

But the macro story in Europe remains starkly different. We believe Germany, where industrial production is in the midst of a year-long malaise, partly due to weak Chinese demand, is headed for a technical recession, the French economy is flatlining, Italian growth is barely positive, and the broader eurozone is stagnant.

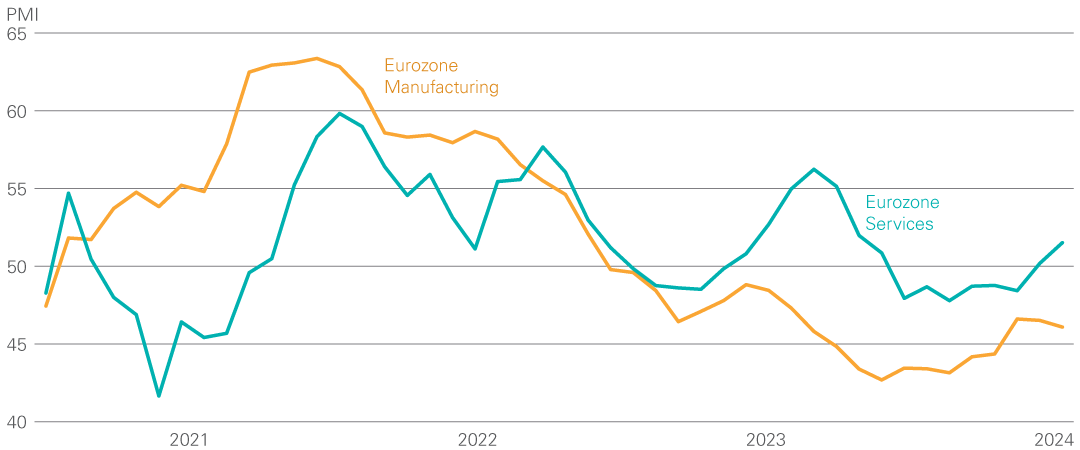

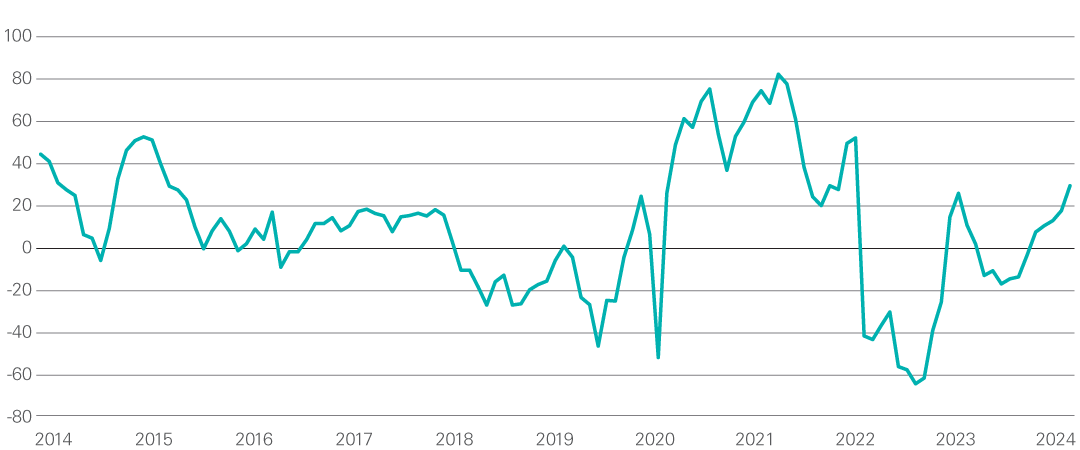

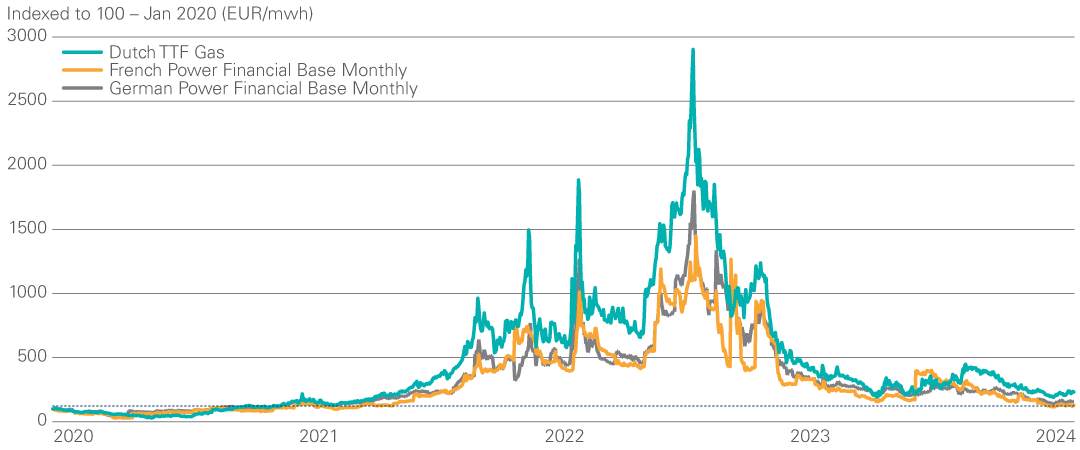

On the other hand, Continental Europe has thus far avoided a deeper recession than many anticipated, with signs that industry and consumers have adjusted to higher rates quicker than anticipated. And the immediate outlook may be brighter than expected. Services purchasing manager index surveys (PMIs), which are a gauge of future activity, are in expansion territory and inflecting upwards in most of the major European economies. Admittedly, that is not true of manufacturing PMIs, which largely remain in contraction territory. Even here there are signs of a possible nascent improvement from a low base (Exhibit 2), with a potential upturn in the inventory cycle looming, along with signs of a possible improvement in German economic sentiment (Exhibit 3). Furthermore, rapidly falling power prices have the potential to boost Europe’s manufacturers in the coming months as energy price hedges roll off, leading to lower input prices (Exhibit 4). Meanwhile, inflation is within sight of the ECB’s 2% target: Annual headline consumer price inflation is now down to 2.4% and core inflation stands at 2.9%, the lowest level since March 2022.

Exhibit 2: Signs of an Upturn in European Manufacturing?

As at 29 March 2024

Source: FactSet

Exhibit 3: Improving German Economic Sentiment – ZEW Financial Market Survey (Economic Expectations)

As at 29 March 2024

Source: FactSet

Exhibit 4: Falling European Power Prices

As at 26 March 2024

Source: FactSet

Against this tough but perhaps slightly improving backdrop, many investors now anticipate that the first ECB rate cut could come as soon as June, with the money market currently anticipating three further rate cuts in the second half of the year. This shift towards monetary easing after two years of tightening could be a boon for European shares, potentially suggesting a positive outlook for European equities in the second half of the year.

On valuations, while there are individual mega-caps that look expensive to us, overall the historically modest valuations on display in Europe’s stock markets mean we still see plenty of upside potential, even after a strong opening quarter for the region’s indices. European stocks remain favorably priced versus international stocks, most obviously versus the United States, where the 13.8x earnings for the MSCI Europe Index compares to a 21.1x multiple for the S&P 500 Index, a near-30-year relative low.

Finally, it is worth noting the resurgence in Europe’s world-leading green energy stocks, which struggled through much of 2022–2023 due to myriad issues, including the Russia-Ukraine war, supply chain headaches, and rising interest rates. However, investors have returned to the sector now that these challenges have mostly dissipated. Danish company Vestas, the world’s leading wind turbine manufacturer, recently reiterated a growing demand outlook for its turbines and easing cost pressures in its annual results. Elsewhere, Alfen, a Dutch company that makes electric charging stations and storage systems, has the potential for significant growth as green infrastructure builds across Europe.

While there remains scope for macro indicators to disappoint as currently high rates continue to bite, on balance, we believe European equity investors can look forward to the coming months with mild optimism. Supportive valuations, the potential for incremental improvements in the macroeconomic picture, helped in part by lower energy costs feeding through to lower manufacturing input prices, and the near-term prospect of a start to the rate-cutting cycle suggest European equities can extend their first-quarter strength.

European Fixed Income

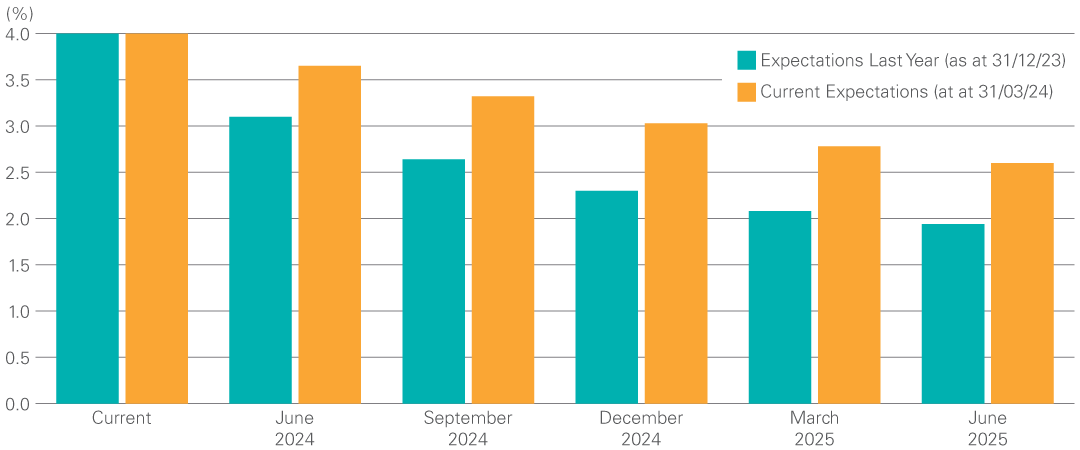

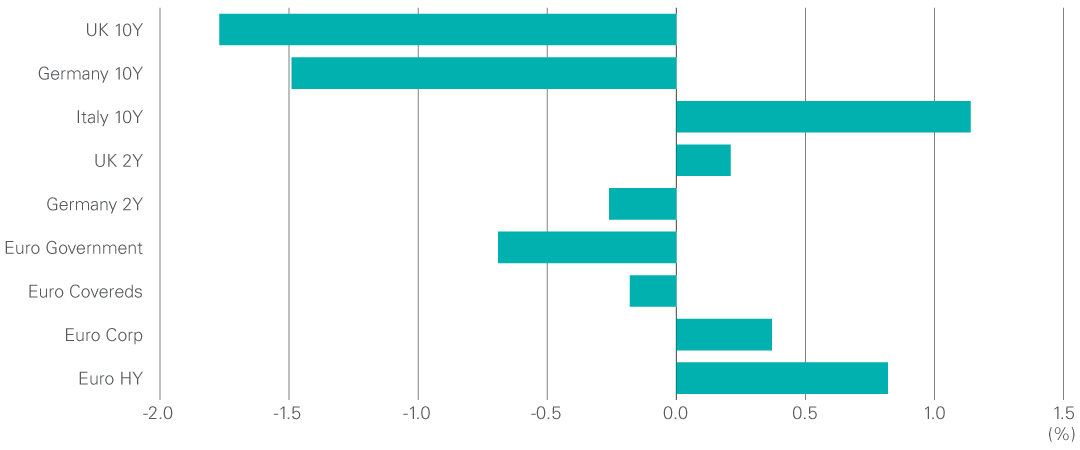

So far, 2024 has turned out differently than most investors initially expected. At the beginning of the year, there was a market consensus that the ECB would quickly begin a cycle of interest rate cuts. However, these expectations did not last long. Central banks’ hawkish statements shifted the narrative back to “higher for longer” (Exhibit 5). In this context, 10-year government bond yields rose significantly, which resulted in negative performance (Exhibit 6). The picture was different for riskier assets such as European high yield. Better-than-expected economic data, together with solid company results, ensured sound performance. Risk premia fell and recession concerns faded.

The European outlook remains mixed for bonds. On the positive side, the ECB seems to be winning its fight against inflation—for now. Both headline and core inflation are in decline. The central bank’s 2% target no longer seems to be too far away, although the final battle could prove to be more difficult. The labor market also remains favorable and wages have risen. The combination of falling inflation, a stable jobs market, and higher wage growth has resulted in rising real consumer incomes. Elsewhere, inflation is not only easing in the eurozone but also in the UK, albeit with a delay.

Exhibit 5: ECB Rate Cut Expectations: December 2023 versus Current Expectations

As at 31 March 2024

Forecasted or estimated results do not represent a promise or guarantee of future results and are subject to change.

Source: Datastream

Exhibit 6: European Fixed Income Returns in Q1 2024

As at 31 March 2024

Source: Datastream

Despite clear indicators of cooling inflation, real-wage growth, and a resilient labour market, recession risks cannot be completely dismissed. Both the eurozone and UK economies have stagnated. Global trade remains weak, which is having a particularly negative impact on export-oriented countries, such as Germany, and the manufacturing sector remains in recession.

In addition to economic challenges, we believe 2024 may present challenges of a different kind. The outcome of various global elections, the possible escalation of conflict in the Middle East, and the fragile state of global real estate markets represent further sources of uncertainty.

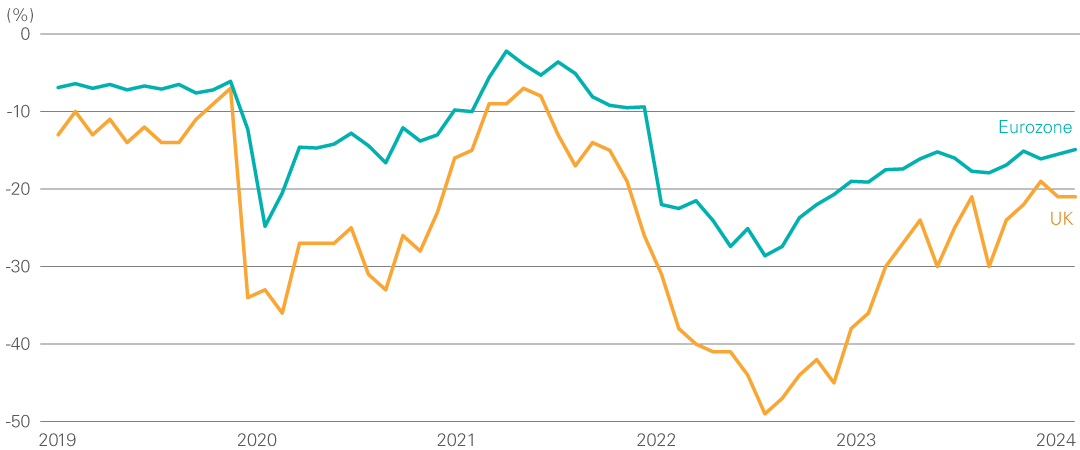

Despite those negative indicators, our outlook is cautiously optimistic for Europe. Although the sentiment indicators are not yet rosy, they have approved (Exhibit 7). Eurozone consumers have more money in their pockets in real terms. Therefore, consumer demand remains solid and well supported. Moreover, given declining inflation rates, the first interest rate cuts in the eurozone could take place from June onwards. The Bank of England (BoE) should also start cutting rates, but with a stronger UK economy, the BoE’s easing cycle might be more moderate in the early stages.

Exhibit 7: Recovering Eurozone and UK Consumer Confidence

As at 31 March 2024

Source: Datastream

What does this mean for the European fixed income market?

In short, we are very positive on the immediate outlook for European bonds. High yield levels translate into an attractive carry, i.e., income for investors, and the prospect of future rate cuts further increases performance potential. Largely stable economic data and robust company results since the beginning of the year also suggest an imminent recession seems less likely, although not impossible.

Despite an improved economic outlook, we prefer covered bonds over investment grade corporate bonds, due to the tight spread, especially in short maturities. We also find Euro high yield to be too expensive, on average, although select issuers and bonds still offer value. In the global high yield market, Nordic high yield debt offers considerable value and performance potential, in our opinion, based on strong fundamentals and higher spreads.

Important Information

Published on 8 April 2024

Download Full PDF

Investment Outlooks

Outlooks provide a forward-looking view, over the short, medium, and/or long term, of asset classes, sectors, regions, or countries from the view of our portfolio managers.