Übersicht

Each week, I provide my views on the global macroeconomic environment, with a look ahead to the coming week and a look back at the previous one. Breaking down the top macro headlines around the world, I explain the key implications for investors—and what I think the mainstream news outlets could be missing. This week’s highlights include:

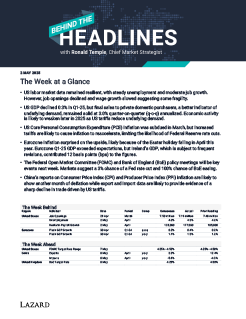

- US labor market data remained resilient, but I continue to believe that labor markets are more fragile than suggested by high-level figures like the unemployment rate.

- Eurozone inflation surprised on the upside, likely because of Easter holidays falling in April this year. I expect economic deceleration caused by US trade policy to further reduce Eurozone inflation in the months ahead, allowing for ECB easing to 1.5% or lower by year end.

- China’s Purchasing Managers’ Index data were weaker than expected for April, and Bloomberg data show a nearly 50% decline in container volume leaving China for the United States in the second half of April. This suggests the real pain of the trade war is just beginning to be felt.

Important Information

Published on May 2, 2025.

This content represents the views of the author(s), and its conclusions may vary from those held elsewhere within Lazard.

These materials have been prepared by Lazard for general informational purposes only on a nonreliance basis and they are not intended to be, and should not be construed as, financial, legal, or other advice.

In preparing these materials, Lazard has assumed and relied upon the accuracy and completeness of any publicly available information and of any other information made available to Lazard by any third parties, and Lazard has not assumed any responsibility for any independent verification of any of such information.

These materials are based upon economic, monetary, market and other conditions as in effect on, and the information available to Lazard as of, the date hereof, unless indicated otherwise. Subsequent developments may affect the information set out in this document and Lazard assumes no responsibility for updating or revising these materials.

These materials may include certain statements regarding future conditions and events. These statements and the conditions and events they describe are inherently subject to uncertainty, and there can be no assurance that any of the future conditions or events described in these materials will be realized. In fact, actual future conditions and events may differ materially from what is described in these materials. Lazard assumes no responsibility for the realization (or lack of realization) of any future conditions or events described in these materials.

No liability whatsoever is accepted and no representation, warranty or undertaking, express or implied, is or will be made by Lazard or any of its affiliates for any information contained herein or for any errors, omissions, or misstatements herein. Neither Lazard nor any of its affiliates makes or has authorized to be made any representations or warranties (express or implied) in relation to the matters contained herein or as to the truth, accuracy, or completeness of this document.

Nothing herein shall constitute a commitment or undertaking on the part of Lazard to provide any service. Lazard shall have no duties or obligations to you in respect of these materials or other advice provided to you, except to the extent specifically set forth in an engagement or other written agreement, if any, that is entered into by Lazard and you.

By accepting this document each recipient agrees to be expressly bound by the foregoing limitations.