Despite a rocky start to the quarter with news of reciprocal tariffs triggering a market sell-off, the overall performance in the Japanese equity market was robust in the second quarter. The TOPIX index rose over 5.8% in AUD terms. However, this growth was quite narrow, driven primarily by three sectors: communication services, technology, and industrials, with artificial intelligence (AI) and defense themes leading the charge.

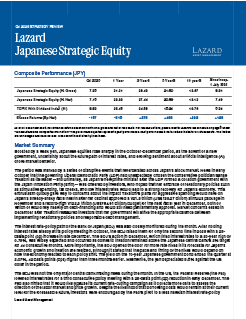

The Lazard Japanese Strategic Equity Fund underperformed the benchmark, returning 3.1% (net of fees). The underperformance all came in early April, with banks, a sector where we are overweight, underperformed sharply during this risk-off period.

In this video update, Portfolio Manager/Analyst, June-Yon Kim discusses the quarter and his outlook for Japanese Equities.

Presenter

Documents

Japanese Strategic Equity

Japanese Strategic Equity

Quick Links

Important Information

The information in this webpage was prepared by Lazard Asset Management Pacific Co ABN 13 064 523 619, AFS License 238432. This material is for informational purposes only. It is not intended to, and does not constitute financial advice, fund management services, an offer of financial products or to enter into any contract or investment agreement in respect of any product offered by Lazard Asset Management and shall not be considered as an offer or solicitation with respect to any product, security, or service in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or unauthorized or otherwise restricted or prohibited. Information and opinions presented have been obtained or derived from sources believed by Lazard to be reliable. All opinions expressed herein are as of the published date and are subject to change.