Infrastructure is the backbone of modern society—providing essential services that touch virtually every aspect of daily life, from transportation and energy to communication and water. Over the past two decades, the listed infrastructure market has evolved significantly from an emerging concept to a well-established and distinct asset class representing approximately 2% of global equity allocations (Exhibit 1).

EXHIBIT 1

Infrastructure Assets Under Management

As of 31 December 2024

Source: Evestment

As one of the earliest investors in the asset class, the Lazard Global Listed Infrastructure team has been at the forefront of listed infrastructure for 20 years. The team launched one of the first specialist portfolios with the inception of the Lazard Global Listed Infrastructure strategy in October 2005.

While infrastructure investing has evolved over time, we believe the fundamental principles for success remain unchanged. Reflecting on our experience managing client assets in this strategy, we have identified three core pillars that we believe underpin long-term success in infrastructure investing:

1. Strict Definition of Infrastructure Is the Foundation of Stability

One of the most notable developments in recent years has been the broadening and changing definition of “infrastructure.” But while the universe of infrastructure investments has expanded, we believe investors should focus specifically on assets that provide essential services, demonstrate monopoly-like qualities, and can generate stable, low-volatility, long-duration cash flows.

These types of assets, which we define as Preferred Infrastructure, are not exposed to the return-eroding forces of competitive markets like many other infrastructure assets are. For example, data centers have garnered significant attention due to soaring valuations and a compelling investment narrative linked to the explosive growth of artificial intelligence. But we believe these assets lack the key characteristics of core infrastructure namely:

- There are not sufficient barriers to entry (data centers are easy to replicate),

- Lack of consistent revenues (short-term contracts are susceptible to pricing pressure), and

- Longevity and stability (this is a nascent area prone to technological disruption).

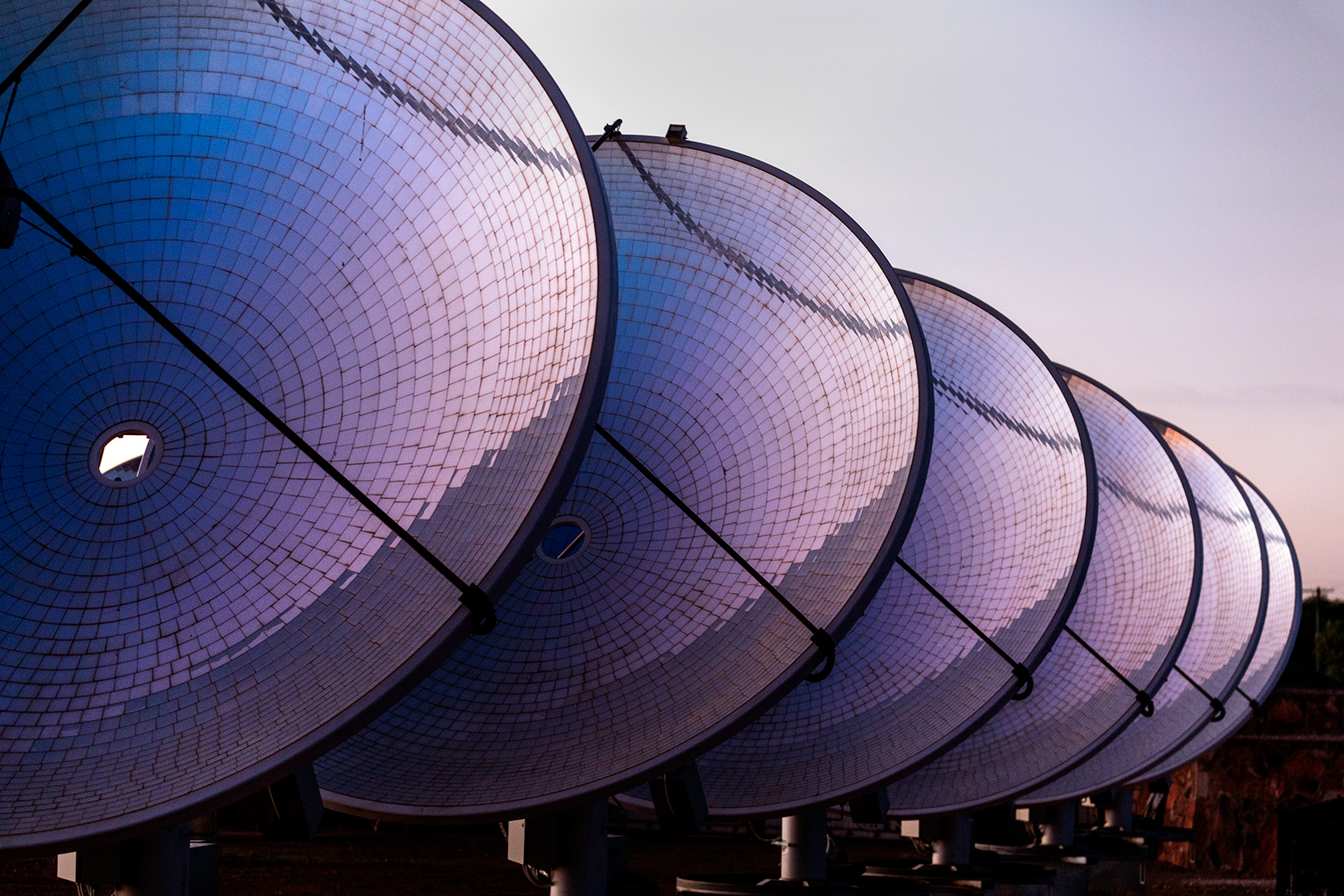

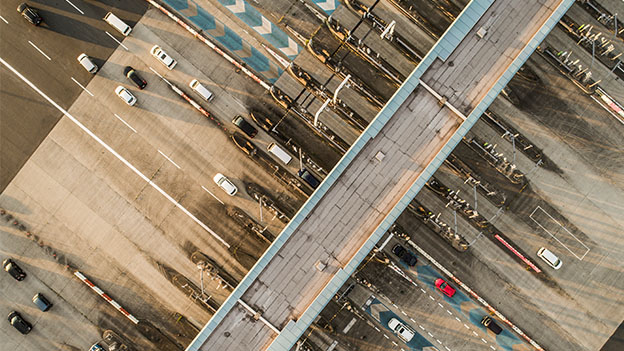

We also avoid companies such as merchant power generators, construction companies, and infrastructure in emerging markets—areas that do not align with our definition of Preferred Infrastructure. Instead, we maintain a rigorous and disciplined approach, focusing on companies that have higher revenue predictability, profitability, and lower volatility. This includes regulated utilities, toll roads, airports, railroads, broadcast towers and assets only in OECD (Organization for Economic Co-operation and Development) countries (Exhibit 2).

EXHIBIT 2

Not all Infrastructure is Created Equal

2. Valuation Discipline Is Key to Long-Term Growth

While listed infrastructure companies are not typically associated with rapid earnings growth, vigilance around valuation multiples is critical for success. In our view, the benefits of the asset class are best realized through an active, selective approach—one that combines valuation discipline with strict criteria for selecting high-quality companies.

Our investment process prioritizes deep fundamental analysis, evaluating characteristics such as regulatory structures, demographic profiles, and modeling volume and pricing dynamics of the underlying assets. This enables us to exploit any discrepancies between the market’s pricing and an asset’s intrinsic value.

Today, the issue of valuation is particularly crucial. Among the nearly 90 stocks within our investable universe, we believe two-thirds are overvalued today.

Exhibit 3 shows a wide dispersion in our value-ranked return expectations across our Preferred Infrastructure Universe. Each bar represents a stock in our Preferred Infrastructure Universe and our expected annual return over three years, based on the assumption that all of the stocks will trade at our valuation in three years’ time. The chart shows the extreme level of dispersion between inexpensive and expensive companies in our universe.

EXHIBIT 3

Value Rank Shows Wide Dispersion in Expected Returns

As of 30 September 2025

1 Over 3 years, assuming all the stocks trade at our valuation in 3 years time.

The opinions and estimates contained in this graph are based on current information and are subject to change. It should not be assumed that any investment was, or will be profitable. Expected returns do not represent a promise or guarantee of future results and are subject to change.

Shown for illustrative purposes only.

Each bar represents an individual stock’s expected return per annum for the next three years. This is based on a comparison of Lazard’s Global Listed Infrastructure team’s intrinsic valuation of the stock three years out, the market price of the stock today and the interim forecast dividends.

As such, we are very selective in finding opportunities that not only meet our strict criteria but also align with the valuations required to achieve long-term returns.

The issue of overvaluation is even more pronounced in private infrastructure markets, where the premiums paid for assets continue to exceed historical norms. For example, private equity funds acquiring UK water assets have paid, on average, a 23% premium to Regulated Asset Base (Exhibit 4). Whereas listed UK water stocks have, on average, traded around 1x RAB, a substantial discount to their PE peers.

EXHIBIT 4

Private Water Companies Sold at a Premium

UK Water Companies

As of 31 December 2024. Past performance is not a reliable indicator of future results.

Source: Lazard, FactSet, Ofwat, Macquarie Equities Limited

Lastly, unlisted airport transactions have traded at a 34% premium, on average, compared to listed airports - excluding the notable COVID period where listed airport valuations briefly exceeded private market valuations (Exhibit 5).

EXHIBIT 5

Airport Transactions at a Premium

As of 31 December 2024. Past performance is not a reliable indicator of future results.

Source: Lazard, FactSet, Macquarie Equities Limited, Ofwat

3. Short-Term Volatility Creates Long-term Alpha Opportunity

In recent years, investors have justified the valuation premium in private markets due to the lower-volatility return profiles that private vehicles have historically delivered. While we recognize the stabilizing role that private allocations can play in a diversified portfolio, we take a different view on short-term market volatility in listed infrastructure: We see it as an opportunity to generate alpha.

While often perceived as a risk, volatility can uncover mispricing opportunities. We believe the ability to actively trade in these markets is an advantage that enables us to construct portfolios that are well-positioned to deliver sustainable, long-term returns.

Over time, our approach has demonstrated resilience. While listed infrastructure may exhibit greater short-term volatility compared to private market allocations, our portfolio has historically experienced significantly lower drawdowns than global equities during market sell-offs (Exhibit 6).

EXHIBIT 6

Low Drawdown in Negative Markets

November 2005 to September 30 2025

As of 30 September 2025

1 Since Inception: November 2005.

Performance represents the Lazard Global Listed Infrastructure (USD Hedged) composite. See notes for composite details. The performance quoted represents past performance. Past performance is not a reliable indicator of future results.

All data in AUD.

Upside/downside capture ratio: A benchmark-relative ratio between a composite and its benchmark that seeks to explain portfolio construction in up and down markets. The return-based characteristics are based on the gross-of-fees composite returns. Please refer to “GIPS® Composite Information” for additional information, including net-of-fee results. The performance quoted represents past performance. Past performance does not guarantee future results. The index is unmanaged and has no fees. One cannot invest directly in an index.

Benchmark: MSCI World

Source: Lazard, MSCI, FactSet

This disciplined and opportunistic approach—utilizing short-term volatility to our advantage—has proven to be a significant driver of returns. Over the last 20 years, GLIF has produced superior risk-adjusted returns in comparison to listed comparable indices (Global Listed Infrastructure Index and MSCI) while maintaining daily liquidity throughout (Exhibit 7).

EXHIBIT 7

20 Years of Outperformance

As of 31 July 2025

1 Since inception is from 31 October 2005.

2 The Global Listed Infrastructure Index (AUD Hedged) from inception to 31 March 2015, is the UBS Global 50/50 Infrastructure and Utilities Net Index (AUD Hedged); from 1 April 2015 to 30 June 2018, the FTSE Developed Core Infrastructure 50/50 100% Hedged to AUD Net Tax Index; and thereafter, the MSCI World Core Infrastructure 100% Hedged to AUD Index.

Performance is based upon a Portfolio. Performance is preliminary and presented net of fees. The performance quoted represents past performance. Past performance does not guarantee future results. Index performance is shown for illustrative purposes only. Lazard Global Listed Infrastructure is not measured versus the performance of any benchmark. Past performance is not a reliable indicator of future results.

Source: Lazard, UBS, FTSE, MSCI, Bloomberg

Conclusion

Since inception, global listed infrastructure has offered diversification in unpredictable times, while delivering reliable income and protection from inflation. With its unique combination of stability, inflation protection, and growth potential, we believe global listed infrastructure continues to be a compelling choice for investors seeking stability in a portfolio.

Related Insights

Important Information

Published on 12 November 2025.

Information and opinions presented have been obtained or derived from sources believed by Lazard to be reliable. Lazard makes no representation as to their accuracy or completeness. All opinions expressed herein are as of the date of publication and are subject to change.

The performance quoted represents past performance. Past performance may not be indicative of future results.

Allocations and security selection are subject to change.

Securities and instruments of infrastructure companies are more susceptible to adverse economic or regulatory occurrences affecting their industries. Infrastructure companies may be subject to a variety of factors that may adversely affect their business or operations, including additional costs, competition, regulatory implications, and certain other factors.

Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss.

No risk management technique or process can guarantee return or eliminate risk in any market environment.

The Global Listed Infrastructure Index (USD Hedged) from inception to 31 March 2015, is the UBS Global 50/50 Infrastructure and Utilities Net Index (USD Hedged); from 1 April 2015 to 30 September 2018, the FTSE Developed Core Infrastructure 50/50 100% Hedged to USD Net Tax Index; and thereafter, the MSCI World Core Infrastructure 100% Hedged to USD Index.

The MSCI World Index is a free-float-adjusted market capitalization index that is designed to measure global developed market equity performance comprised of developed market country indices.

The indices are unmanaged and have no fees. One cannot invest directly in an index.

Certain information included herein is derived by Lazard in part from an MSCI index or indices (the “Index Data”). However, MSCI has not reviewed this product or report, and does not endorse or express any opinion regarding this product or report or any analysis or other information contained herein or the author or source of any such information or analysis. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any Index Data or data derived therefrom.

Certain information contained herein constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “intent,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events may differ materially from those reflected or contemplated in such forward-looking statements.

This content represents the views of the author(s), and its conclusions may vary from those held elsewhere within Lazard Asset Management. Lazard is committed to giving our investment professionals the autonomy to develop their own investment views, which are informed by a robust exchange of ideas throughout the firm.

This document reflects the views of Lazard Asset Management LLC, Lazard Frères Gestion or its affiliates ("Lazard") based upon information believed to be reliable as of the publication date. There is no guarantee that any forecast or opinion will be realized. This document is provided by Lazard for informational purposes only. Nothing herein constitutes investment advice or a recommendation relating to any security, commodity, derivative, investment management service, or investment product. Investments in securities, derivatives, and commodities involve risk, will fluctuate in price, and may result in losses. Certain assets held in Lazard’s investment portfolios, in particular alternative investment portfolios, can involve high degrees of risk and volatility when compared to other assets. Similarly, certain assets held in Lazard’s investment portfolios may trade in less liquid or efficient markets, which can affect investment performance. Past performance does not guarantee future results. The views expressed herein are subject to change, and may differ from the views of other Lazard investment professionals.

This document is intended only for persons residing in jurisdictions where its distribution or availability is consistent with local laws and Lazard’s local regulatory authorizations. Please visit www.lazardassetmanagement.com/global-disclosure for the specific Lazard entities that have issued this document and the scope of their authorized activities.

![Infrastructure Opportunities Not Seen in 30 Years [Video] Infrastructure Opportunities Not Seen in 30 Years [Video]](/content/dam/getty-stock-assets/infrastructure-opportunities-article-thumbnail.jpg)