Summary

Each week, I provide my views on the global macroeconomic environment, with a look ahead to the coming week and a look back at the previous one. Breaking down the top macro headlines around the world, I explain the key implications for investors—and what I think the mainstream news outlets could be missing. This week’s highlights include:

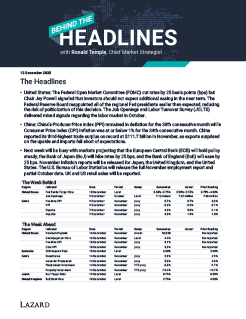

- The Federal Reserve cut rates by 25 basis points (bps), but Fed Chair Jerome Powell signaled that investors should not expect additional easing in the near term. I believe investors should temper their confidence regarding any near-term rate views until government data releases return to a timely schedule and we are able to piece together a more robust assessment of the economy.

- China’s Consumer Price Index inflation accelerated as expected, but Producer Price Index data slipped slightly further into deflation. Despite the anti-involution campaign aimed at reducing “destructive competition” and mitigating deflationary pressures, I expect inflation to remain undesirably low.

- Next week will be a busy week for central banks. I expect the European Central Bank to hold policy steady, the Bank of Japan to l hike rates by 25 bps, and the Bank of England to ease by 25 bps.

Important Information

Published on December 12, 2025.

This content represents the views of the author(s), and its conclusions may vary from those held elsewhere within Lazard.

These materials have been prepared by Lazard for general informational purposes only on a nonreliance basis and they are not intended to be, and should not be construed as, financial, legal, or other advice.

In preparing these materials, Lazard has assumed and relied upon the accuracy and completeness of any publicly available information and of any other information made available to Lazard by any third parties, and Lazard has not assumed any responsibility for any independent verification of any of such information.

These materials are based upon economic, monetary, market and other conditions as in effect on, and the information available to Lazard as of, the date hereof, unless indicated otherwise. Subsequent developments may affect the information set out in this document and Lazard assumes no responsibility for updating or revising these materials.

These materials may include certain statements regarding future conditions and events. These statements and the conditions and events they describe are inherently subject to uncertainty, and there can be no assurance that any of the future conditions or events described in these materials will be realized. In fact, actual future conditions and events may differ materially from what is described in these materials. Lazard assumes no responsibility for the realization (or lack of realization) of any future conditions or events described in these materials.

No liability whatsoever is accepted and no representation, warranty or undertaking, express or implied, is or will be made by Lazard or any of its affiliates for any information contained herein or for any errors, omissions, or misstatements herein. Neither Lazard nor any of its affiliates makes or has authorized to be made any representations or warranties (express or implied) in relation to the matters contained herein or as to the truth, accuracy, or completeness of this document.

Nothing herein shall constitute a commitment or undertaking on the part of Lazard to provide any service. Lazard shall have no duties or obligations to you in respect of these materials or other advice provided to you, except to the extent specifically set forth in an engagement or other written agreement, if any, that is entered into by Lazard and you.

By accepting this document each recipient agrees to be expressly bound by the foregoing limitations.