Lazard Listed Infrastructure ETF

GLIX is an actively managed ETF designed to invest in monopolistic, essential services infrastructure companies.

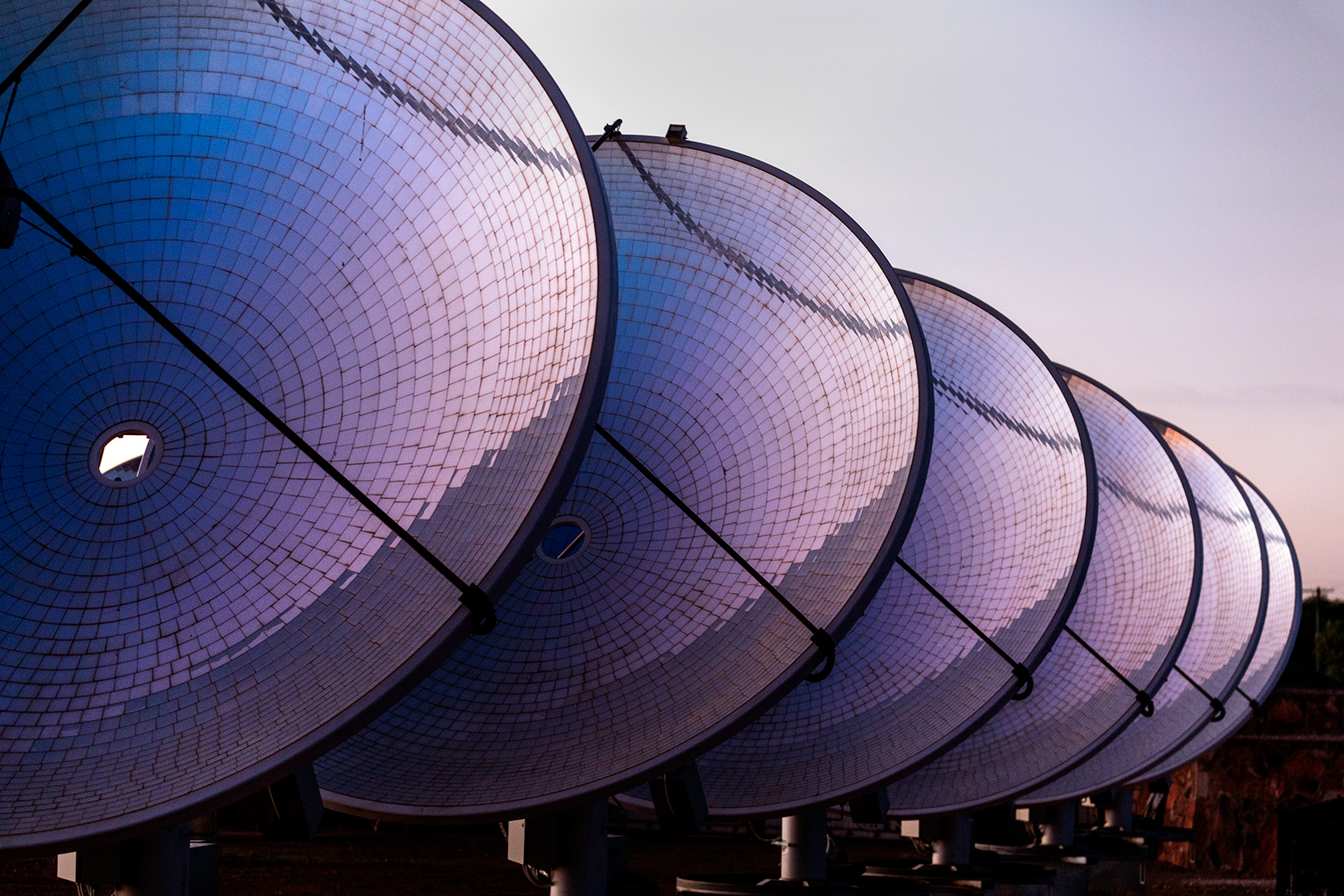

Infrastructure Is the Backbone of Modern Society

Spanning roads, bridges, utilities, and airports, infrastructure is the asset class that keeps the world connected. As spending for new projects accelerates globally—and as the modernization of aging systems becomes a greater priority—we believe the sector will continue to offer compelling investment opportunities. GLIX is designed to invest in a carefully selected portfolio of infrastructure companies that have the potential to offer:

Diversification

Listed infrastructure can offer a balanced risk/return profile and enhance diversification.

Low Volatility

Historically, listed infrastructure has generated lower-volatility returns than equities.

Inflation Resilience

Regulated infrastructure companies can offer inflation-linked revenues, making them a strong hedge against rising prices.

Steady Income Generation

Infrastructure-related cash flows and asset-backed value can potentially offer long-term investors reliable, growing income.

Not All Infrastructure Is Created Equal

We invest exclusively in Preferred Infrastructure: a narrow subset of the global infrastructure market that we believe can generate lower-volatility returns, higher revenue predictability, and greater profitability.

By leveraging an active, bottom-up stock selection process, we aim to build a portfolio with the following characteristics:

- Highly Selective

Less than 25% of all listed infrastructure companies meet our strict criteria for Preferred Infrastructure.

- Inflation-Resilient

We invest in monopoly-like assets with cash flows that are directly tied to inflation through contracts, regulations, or concession agreements. - Risk-Mitigated

Our strategy is currency-hedged, making the portfolio less susceptible to sudden changes in exchange rates.

Where to Put GLIX in a Portfolio?

GLIX aims to invest in a portfolio of 25–50 Preferred Infrastructure companies, targeting a balanced risk-reward profile positioned between equities and fixed income in terms of expected returns and volatility.

We take a highly discerning approach to stock selection. We aim to invest in the most attractively valued companies across the global infrastructure market to achieve outperformance.

Matthew Landy

Portfolio Manager/Analyst, GLIX

Strong Foundation, Stable Assets

How to Invest in Lazard ETFs

Lazard ETFs trade intraday on an exchange and are available through various channels, including broker-dealers, investment advisors, and other financial services.

You can invest through your brokerage account or talk to your financial advisor.

Related Insights

Important Information

The financial data presented is provided by external sources. Lazard Asset Management LLC takes reasonable care to ensure that the information provided is correct, but it neither warrants, represents, nor guarantees the content of the information nor does it accept responsibility for errors, inaccuracies, omissions or inconsistencies.

Please consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. For more complete information about Lazard ETFs and current performance, you may obtain a prospectus or summary prospectus by calling 800-823-6300 or going to www.lazardassetmanagement.com. Read the prospectus or summary prospectus carefully before you invest. The prospectus and summary prospectus contain investment objectives, risks, charges, expenses, and other information about the Portfolio and Lazard ETFs that may not be detailed in this document.

The Lazard ETFs are distributed by Foreside Fund Services, LLC.

Investment Products: NOT FDIC INSURED I NOT BANK GUARANTEED I MAY LOSE VALUE

Forward-looking figures represent expected returns. Expected returns do not represent a promise or guarantee of future results and are subject to change.

Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Securities in certain nondomestic countries may be less liquid, more volatile, and less subject to governmental supervision than in one’s home market. The values of these securities may be affected by changes in currency rates, application of a country’s specific tax laws, changes in government administration, and economic and monetary policy. Emerging markets securities carry special risks, such as less developed or less efficient trading markets, a lack of company information, and differing auditing and legal standards. The securities markets of emerging markets countries can be extremely volatile; performance can also be influenced by political, social, and economic factors affecting companies in emerging markets countries.