Lazard Emerging Markets Opportunities ETF

EMKT is an actively managed ETF that taps into the growth potential of emerging markets leaders.

Emerging markets are a powerful engine for global growth.

We believe emerging markets—fueled by changing demographics and policy reforms—are on the cusp of a resurgence.

Rising GDP Share

The contribution from emerging markets to global GDP has substantially increased over the last two decades.

Accelerated Growth

Emerging markets often outpace developed markets in economic growth, driven, in part, by industrialization and urbanization.

Evolving Consumer Patterns

The middle class is growing across emerging markets as population sizes increase and consumption patterns accelerate.

Growth at a Discount

Emerging markets equities are currently trading at a 40% discount to US equities—one standard deviation below their 20-year average discount of 30%.

Historical and Projected Price/Earnings (Next 12 Months)

As of 30 September 2025

Source: FactSet

Our Edge

Since launching our first emerging markets strategy more than 30 years ago, we have developed unique solutions across various geographies, capital structures, and market cycles.

- Localized Expertise

Our on-the-ground presence supports a fuller understanding of local dynamics and market assessments. - Forward-Looking Perspective

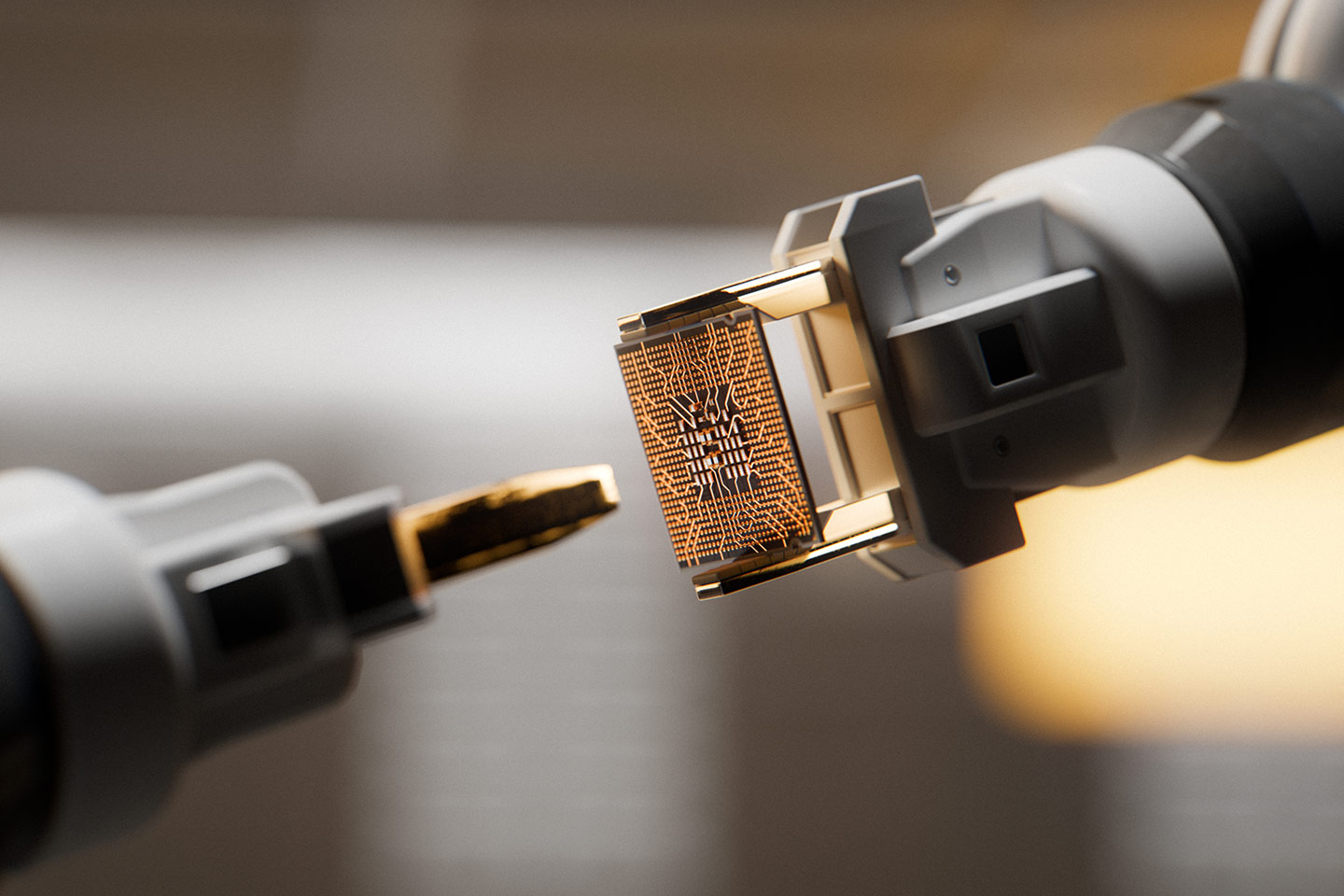

Our expertise allows us to recognize the evolution of unique market phases and new opportunities. - Multi-Faceted Approach

Our bottom-up analysis helps us identify sound innovation, durable competitive advantages, and growth opportunities. - Active Management

Our investment team employs a fundamental approach that spans capital structures and asset classes.

Building a Portfolio for the Long Term

Our specialized investment team aims to identify high potential opportunities across emerging markets, capturing the best opportunities for structural growth and value creation.

We believe the intrinsic value of a business is tied to its financial productivity and valuation. That’s why, at a company level, we seek to maximize stock-specific return drivers and minimize unintended factor risks.

The portfolio is built around our strict definition of financial productivity, characterized by robust earnings, healthy cash flow, and/or compelling asset values.

We believe that scouring the world and meeting with companies on a one-on-one basis is crucial for understanding their fundamentals, identifying key drivers of their businesses, and, ultimately, constructing portfolios for our clients from the ground up.

Rohit Chopra

Lead Portfolio Manager/Analyst, EMKT

Grow Where the World Is Growing

How to Invest in Lazard ETFs

Lazard ETFs trade intraday on an exchange and are available through various channels, including broker-dealers, investment advisors, and other financial services.

You can invest through your brokerage account or talk to your financial advisor.

Related Insights

Important Information

The financial data presented is provided by external sources. Lazard Asset Management LLC takes reasonable care to ensure that the information provided is correct, but it neither warrants, represents nor guarantees the content of the information nor does it accept responsibility for errors, inaccuracies, omissions or inconsistencies.

Please consider a fund's investment objectives, risks, charges, and expenses carefully before investing. For more complete information about Lazard ETFs and current performance, you may obtain a prospectus or summary prospectus by calling 800-823-6300 or going to www.lazardassetmanagement.com. Read the prospectus or summary prospectus carefully before you invest. The prospectus and summary prospectus contain investment objectives, risks, charges, expenses, and other information about the Portfolio and Lazard ETFs that may not be detailed in this document. The Lazard ETFs are distributed by Foreside Fund Services, LLC.

Investment Products: NOT FDIC INSURED I NOT BANK GUARANTEED I MAY LOSE VALUE

Forward looking figures represent expected returns. Expected returns do not represent a promise or guarantee of future results and are subject to change.

Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Securities in certain nondomestic countries may be less liquid, more volatile, and less subject to governmental supervision than in one's home market. The values of these securities may be affected by changes in currency rates, application of a country's specific tax laws, changes in government administration, and economic and monetary policy. Emerging markets securities carry special risks, such as less developed or less efficient trading markets, a lack of company information, and differing auditing and legal standards. The securities markets of emerging markets countries can be extremely volatile; performance can also be influenced by political, social, and economic factors affecting companies in emerging markets countries.

The MSCI Emerging Markets Index is a free-float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The MSCI Emerging Markets Index consists of emerging markets country indices including: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. The index is unmanaged and has no fees. One cannot invest directly in an index.

Certain information included herein is derived by Lazard in part from an MSCI index or indices (the “Index Data”). However, MSCI has not reviewed this product or report, and does not endorse or express any opinion regarding this product or report or any analysis or other information contained herein or the author or source of any such information or analysis. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any Index Data or data derived therefrom.

The S&P 500 Index is a market capitalization-weighted index of 500 companies in leading industries of the US economy. The index is unmanaged and has no fees. One cannot invest directly in an index.