Lazard Active ETFs: Power Your Portfolio

Combining decades of experience, rigorous research and deep local insights with the benefits of an ETF vehicle.

Being Active Matters

An Experienced Team Behind Each Ticker

With decades of global market experience, our teams use Lazard’s deep network to identify opportunities and manage risks that index-tracking strategies may overlook.

Staying Ahead of Market Shifts, So You Don’t Have To

Access to professionally-managed strategies in a flexible ETF structure with the potential to outperform through active decision-making.

Active Management, Every Day

Our ETF options focus on specialized equity and real assets strategies where active management can add the most value.

Discover Our Active ETFs

Why Active ETFs?

Each Lazard ETF is built with structural advantages that we believe can drive sustained success.

Tax Efficiency

Designed to help investors keep more of their returns by reducing tax liabilities, particularly valuable for long-term investors looking to maximize after-tax performance.

Tradability

Our ETFs trade intraday so investors can respond quickly to market opportunities or risks.

Transparency

Our ETFs disclose their holdings daily, giving investors clear visibility and greater confidence in portfolio composition.

Let’s Keep in Touch

Get in touch with our team to explore how Lazard Active ETFs can help enhance your portfolio.

By hitting submit, you will be subscribing to our marketing communications in addition to reaching out for support.

How to Invest in Lazard ETFs

Lazard ETFs are available through various channels, including broker-dealers, investment advisors, and other financial services. Talk to your financial advisors about Lazard ETFs or buy through your brokerage account.

Documents

Related Insights

Investment Insights

Investment Insights

Understanding the Unique Liquidity Structure of ETFs

As exchange-traded funds rise in popularity, it is important for investors to understand the unique liquidity features that set them apart from stocks.

Insights

Insights

Rise of Active ETFs: What Investors Should Know

Historically, most exchange traded funds (ETFs) have been passive. But that’s starting to change as traditional fund managers realize that the ETF is a great wrapper and investment vehicle for a broad range of strategies.

Insights

Insights

How ETFs Can Deliver Tax Benefits

Returns matter for investors, but what really matters are after-tax returns. Fortunately, the way exchange-traded funds (ETFs) are designed to help minimize the taxes paid by investors holding the ETF.

Investment Insights

Investment Insights

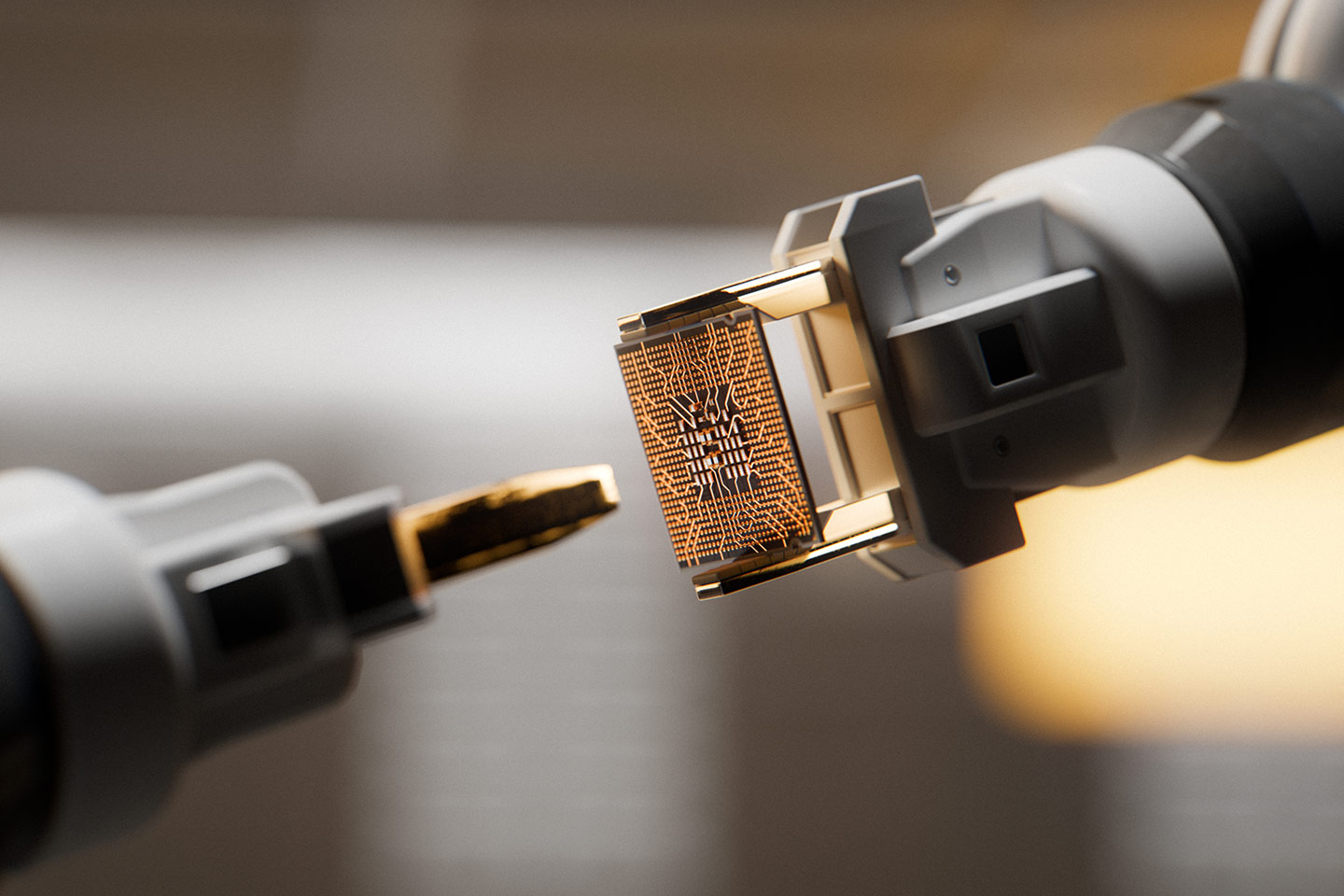

The Robots Are Here

Expected to grow dramatically over the next decade, the global robotics market is poised to reshape industries and regions, especially emerging Asia.

Important Information

The financial data presented is provided by external sources. Lazard Asset Management LLC takes reasonable care to ensure that the information provided is correct, but it neither warrants, represents nor guarantees the content of the information nor does it accept responsibility for errors, inaccuracies, omissions or inconsistencies.

Please consider a fund's investment objectives, risks, charges, and expenses carefully before investing. For more complete information about Lazard ETFs and current performance, you may obtain a prospectus or summary prospectus by calling 800-823-6300 or going to www.lazardassetmanagement.com. Read the prospectus or summary prospectus carefully before you invest. The prospectus and summary prospectus contain investment objectives, risks, charges, expenses, and other information about the Portfolio and Lazard ETFs that may not be detailed in this document.

The Lazard ETFs are distributed by Foreside Fund Services, LLC.

Investment Products: NOT FDIC INSURED I NOT BANK GUARANTEED I MAY LOSE VALUE

Forward looking figures represent expected returns. Expected returns do not represent a promise or guarantee of future results and are subject to change.

Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Securities in certain nondomestic countries may be less liquid, more volatile, and less subject to governmental supervision than in one's home market. The values of these securities may be affected by changes in currency rates, application of a country's specific tax laws, changes in government administration, and economic and monetary policy. Emerging markets securities carry special risks, such as less developed or less efficient trading markets, a lack of company information, and differing auditing and legal standards. The securities markets of emerging markets countries can be extremely volatile; performance can also be influenced by political, social, and economic factors affecting companies in emerging markets countries.

Alpha is a measure of a stock's performance relative to a benchmark index. A positive alpha indicates the stock has outperformed the market, while a negative alpha means it has underperformed.